Understanding VAT: A Global Perspective

Value-Added Tax (VAT) is more than just a line item on an invoice; it is an essential component of the economic landscape across Europe and beyond. Traditionally seen as a consumption tax, VAT applies to the additional value created at each stage of production. This unique structure allows for a flow of credits that businesses can claim back, ensuring that the ultimate burden falls on the end consumer.

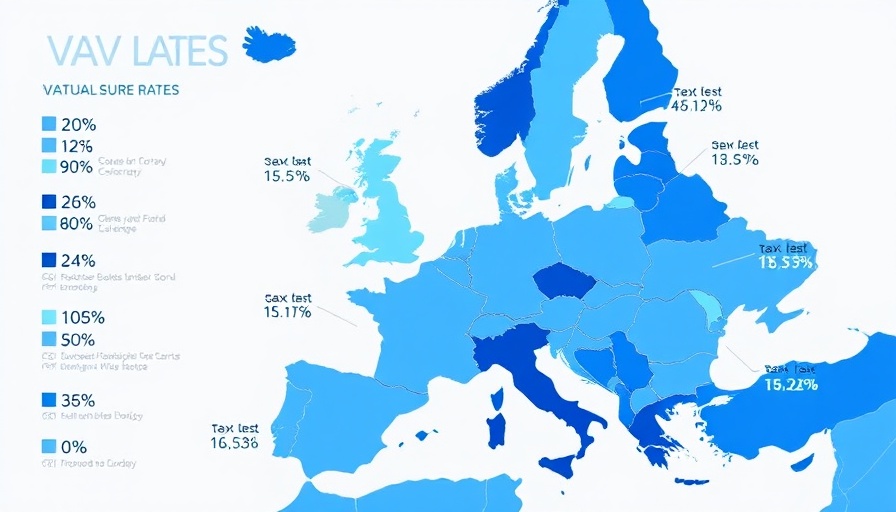

The Basics of VAT Rates in Europe

As of January 2025, VAT rates in Europe reveal a fascinating tapestry of taxation policies tailored to individual countries. Countries in the European Union (EU) exhibit a range of VAT rates, from standard rates to reduced and super-reduced rates, indicating varying strategies to stimulate consumption or support specific goods. This harmonization by the EU attempts to create a level playing field, encouraging fair competition while allowing flexibility for member states to cater to local economic needs.

Impacts of VAT on Small to Medium Enterprises (SMEs)

For small to medium enterprises (SMEs), understanding VAT is crucial not only for compliance but also for financial planning. With VAT accounting dictating cash flow and pricing strategies, SMEs must adapt to the rate variations between different countries. Mismanagement of VAT can lead to cash flow issues, which is why staying informed and vigilant about changes in regulations and rates is essential for these businesses.

VAT Trends: 2025 and Beyond

Looking ahead, trends suggest a potential for further harmonization of VAT across Europe, driven by the need for efficient revenue collection and economic stimulation. Countries that currently have higher VAT rates may consider cutting them in response to consumer pressure, while those with more favorable rates might face scrutiny to align closer with EU standards. The landscape thus remains dynamic, providing businesses with both challenges and opportunities to adapt.

Understanding the Social Implications of VAT

The social efficacy of VAT cannot be overlooked. As a regressive tax, VAT disproportionately affects lower-income individuals. While it serves as a significant revenue stream for governments, it remains important to consider the broader implications—how VAT impacts consumer purchasing behavior and economic inequality. Understanding these factors is vital for businesses trying to navigate the market effectively.

Conclusion: Planning for the Future

As we move through 2025, the VAT landscape will continue to evolve. Businesses must prioritize staying informed about these changes and understanding their implications. Whether through adapting pricing strategies or aligning with compliance requirements, staying ahead of VAT developments will play a pivotal role in ensuring sustainability for small to medium enterprises in a competitive market.

Add Row

Add Row  Add

Add

Write A Comment